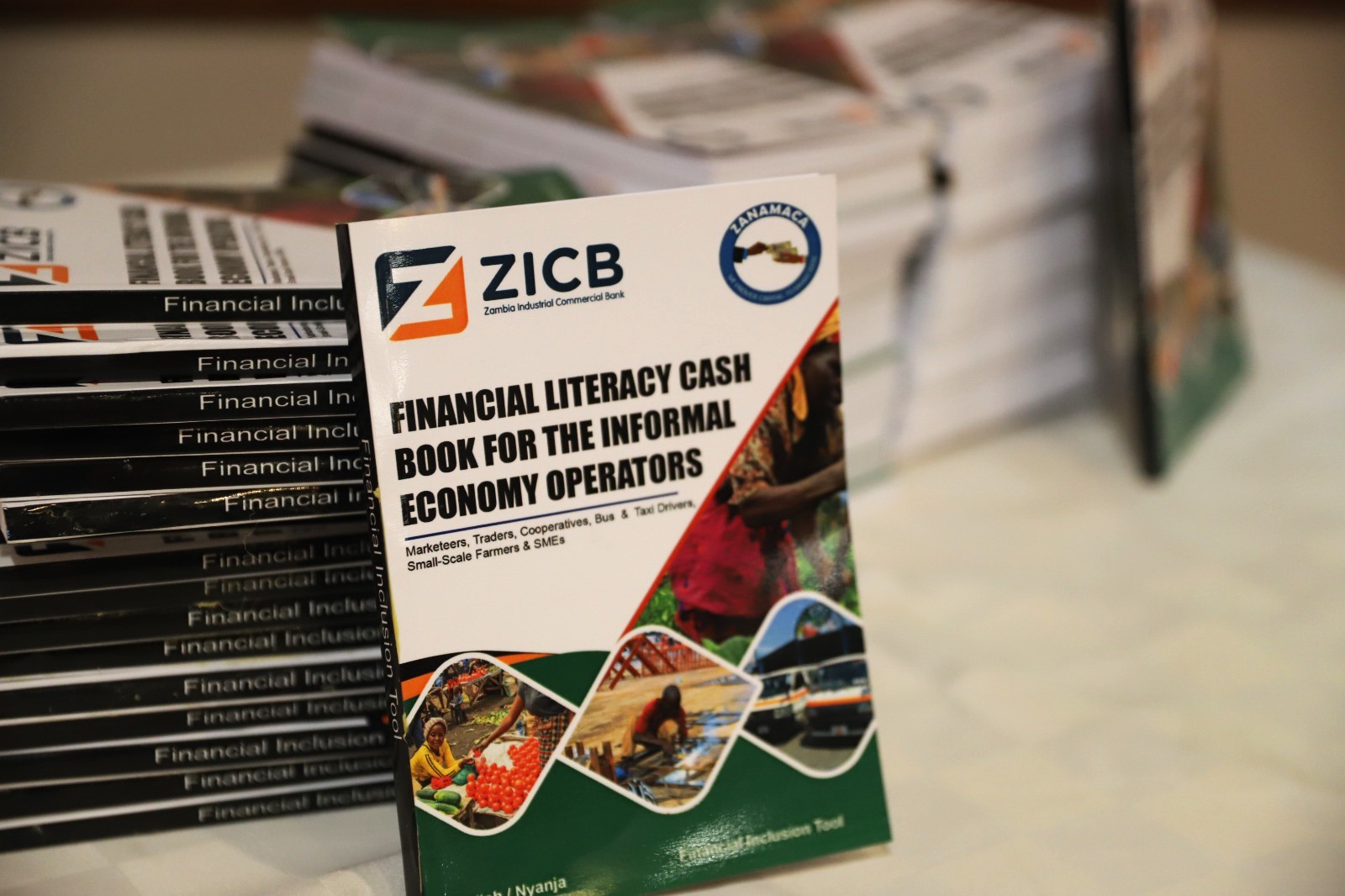

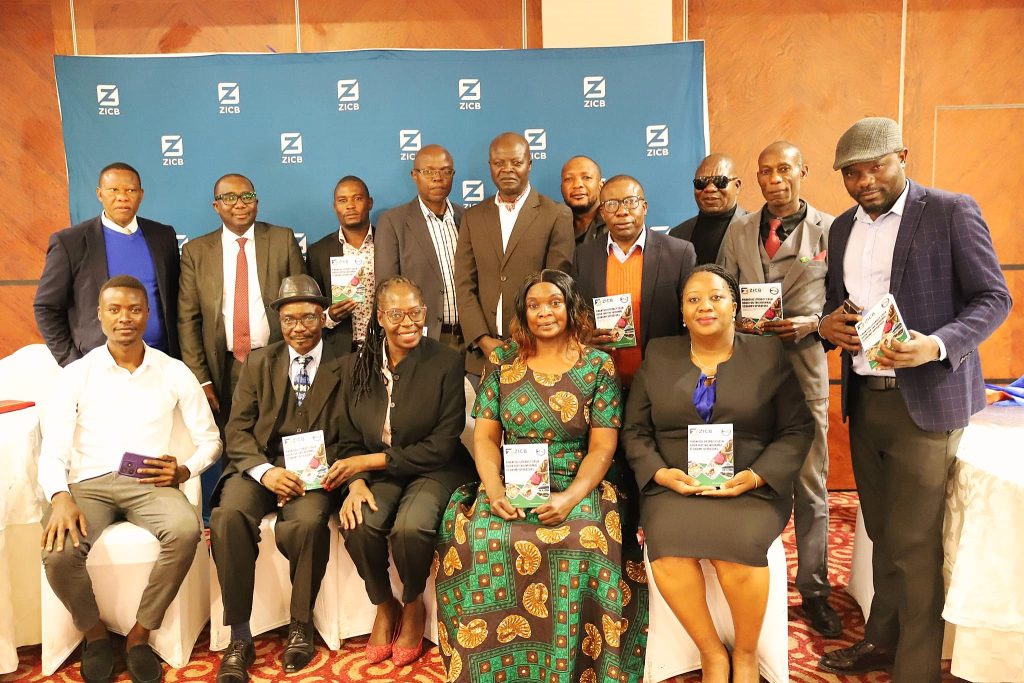

The Zambia Industrial Commercial Bank (ZICB) has taken a step towards boosting financial literacy in small businesses through the launch, at an event in Lusaka, of a Financial Literacy Cashbook tailored for the dynamic informal sector.

This initiative is a partnership with the National Pension Scheme Authority (NAPSA), and the Zambia National Marketeers Credit Association (ZANAMACA), an institution that caters to over 800,000 marketeers nationwide.

Speaking at the media breakfast event, ZICB Acting Chief Executive Officer, Dr. Louis Kabula said the financial literacy cashbook is an important tool to facilitate the growth of the informal sector, ensuring that marketeers under ZANAMACA can now aspire to greater economic security and social protection.

“By maintaining accurate financial records, marketeers will be better positioned to access loans and other financial services from ZICB that can propel their businesses forward”, he explained.

Dr. Kabula further urged all marketeers, traders, cooperatives, bus and taxi drivers, small-scale farmers and MSMEs to embrace this tool and the financial literacy training that accompanies it.

Meanwhile, NAPSA’s Head of Customer Service, Ason Banda mentioned that the institution is dedicated to extending social security services to marketeers in the informal sector, who have historically been excluded from these benefits.

“Social Security is a human right, and most of us only concentrate of the employer and employee relationship while forgetting the fact that entrepreneurs also need that protection because someday, they will not have the energy to do their business due to old age and/or sickness”, he said.

ZANAMACA President, Mupila Kameya explained that, by taking advantage of the recently launched National Strategy on Extension of Social Security Coverage to the Informal Economy Workers (2023- 2027), the institution will conduct a national rollout to distribute the Financial Literacy Cash Books.

He further thanked ZICB for heeding their call to help ZANAMACA publish the Financial Literacy Cash Book, which is one of the initiatives of ZANAMACA to support the Government of His Excellency Mr. Hakainde Hichilema, President of the Republic of Zambia on the need to include everyone in the development of the country.

This endeavour is a result of the robust partnership between ZICB and NAPSA that is formalized through a Memorandum of Understanding (MOU), under the Extension of Coverage to Informal Sector (ECIS) project.

The purpose of this MOU is to facilitate the provision of short-term credit products and services to the informal sector in line with the Bank’s strategic position as the MSME partner of choice for entrepreneurs who may currently be excluded from social security services.